Dividend Reinvestment Plan

Perpetual Equity Investment Company Limited announced its Dividend Reinvestment Plan (DRP) offer in July 2015.

For shareholders who elect to participate in the DRP, that election continues for each reporting period unless you choose to vary or cancel your participation using the form below.

If you are already participating in the DRP and wish to remain so, there is no further action to be taken. Should you wish to check your participation, please visit the registry's Investor Centre.

Dividend reinvestment plan rules

Benefits of participating in a DRP

Participation in any DRP is voluntary and investors may apply to participate, change their level of participation, or chose not to participate in the DRP at any time, subject to the notice periods outlined by the publicly traded entity.

Flexibility to receive some or all of your dividends in the form of shares rather than cash, which is an efficient way to increase your investment in the company.

While you may not receive a cash distribution, reinvesting dividends can have a compounding effect per the example illustrated below.

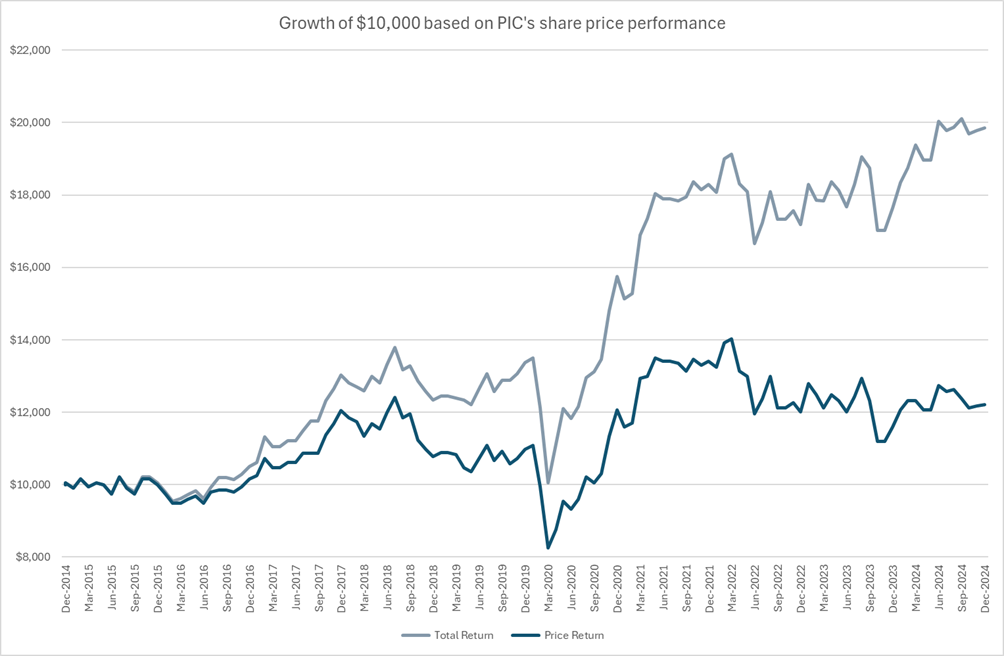

The chart below shows the performance of $10,000 invested in PIC. Total return is the performance of PIC’s share price assuming the reinvestment of dividends on ex-date. An investor that fully participated in the DRP between 2015 and 31 December 2024 would have a return of 76.5% or their $10,000 investment would be worth $19,862.

In contrast, an investor that elected cash distributions for each dividend between 2015 and now would have a return of 22.2% or their $10,000 investment would be worth $12,218 (as indicated by the price return).

*Source: FactSet. Performance presented in AUD, based on PIC’s ASX share price assuming reinvestment of dividends on ex-date. Past performance is not indicative of future performance.

Shares allocated under the DRP are free of brokerage, commission and stamp duty costs*

*For capital gains tax purposes, shares allocated under the DRP will have an acquisition date equal to the payment date for the relevant dividend and a cost base equal to the amount of the cash dividend entitlement which is reinvested. You may be subject to tax on disposal of the shares if the sale proceeds received are more than the cost base of the shares.

Shares may be issued at a discount to the market price of the Company’s shares.

Shares issued under the DRP rank equally with existing shares.

A key risk of participating in a DRP is that investors do not have control over the price that shares under the DRP are issued at. There is a risk that market volatility or other factors may cause shares issued under the DRP to decrease in value.

A dividend statement outlining the dividend calculation, including franking credits, and the details of any new shares allocated under the DRP will be issued to you. You may be subject to capital gains tax on disposal of the shares allocated under the DRP if the sale proceeds received are more than the cost base of the shares.