Select Harvest (ASX:SHV) is an Australian-based grower, processor and marketer of almonds and almond-based value-added products. The business owns and leases over 7,500 hectares of almond orchards across New South Wales, Victoria and South Australia and has two processing facilities located in Victoria.

SHV has been held in the Perpetual Equity Investment Company (ASX:PIC) portfolio since early 2018 and was initially purchased in the low $5 range.

During May, SHV released a strong set of 1H19 results that was supportive of our investment thesis. They reported 1H19 earnings before interest and taxation (EBIT) of $31m, which was 77% ahead of the prior corresponding period. The strong result was driven entirely by the performance of the core almond division.

This division has three primary drivers of profitability, being the volume of almonds produced from SHV’s farms, the cost of growing and processing the almonds, and finally the realised price when the almonds are sold.

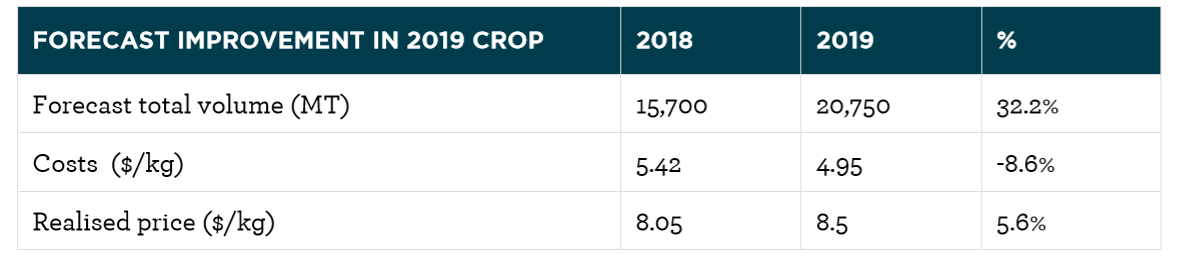

As can be seen from the table below, the forecasts for the 2019 crop show a significant improvement in all three components when compared to the 2018 crop.

Source: Company accounts, Perpetual Investments analysis

We were most pleased with the significant increase in production volumes and the improvement in cost efficiencies given these are within the company’s control. The 32% growth in production was a result of an 8% increase in the almond-bearing acreage due to tree maturation and a 23% increase in yields.

The improvement in yields has been driven by the company’s strategy to focus on its horticultural program and invest capital in frost fans, which protects the crop from damage during frost events. The increased almond volumes and the focus on processing efficiency drove an 8.6% reduction in total costs per kg.

This is impressive considering the business had to absorb a 34% increase in water irrigation costs as spot water prices in the Murray Darling Basin increased sharply due to the ongoing dry conditions on the east coast of Australia.

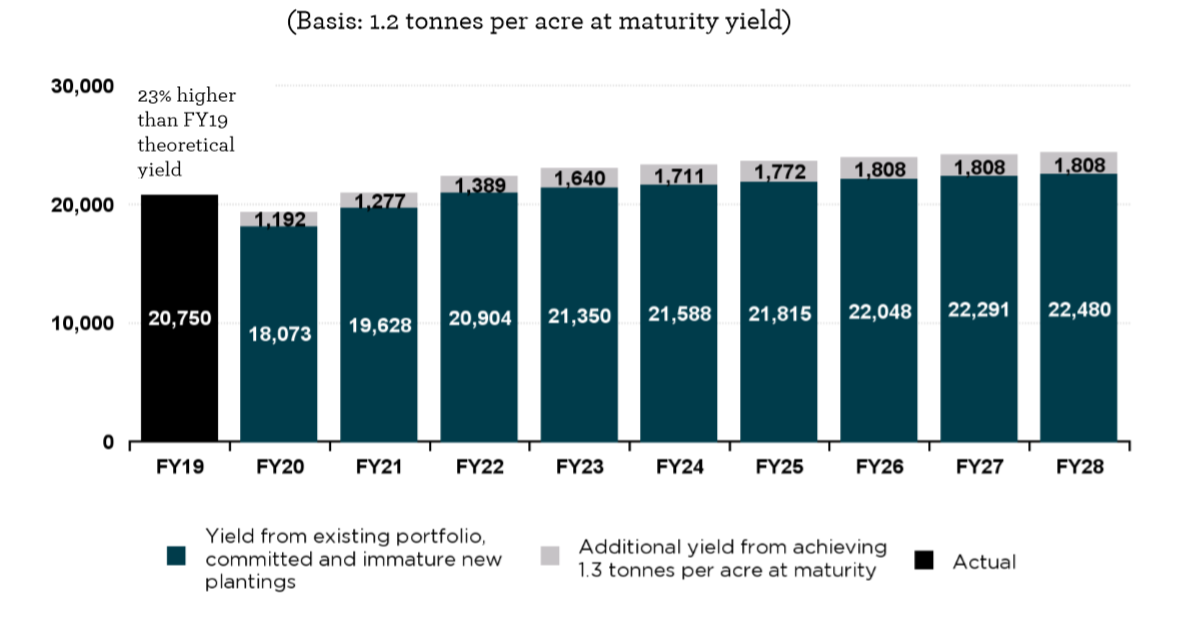

Due to the significant investment in new plantings over FY13-18 and assuming stable yields, SHV will deliver ongoing growth in total almond production from 2020. Almond orchards take seven years to reach full maturity and therefore this growth in total production will be achieved without any further investment in new orchard plantings.

SHV was able to deliver yields 23% higher than theoretical in FY19. If they can repeat this moving forward, we at Perpetual believe there is further upside to the production growth as outlined in the chart below

Source: SHV company presentation

We are also attracted to the long-term dynamics of the almond industry with global consumption having grown 6-8% over the past five years. Almond demand and consumption continue to grow with the ongoing focus from consumers on healthy foods and the shift to plant-based diets. The increasing prevalence of almond milk as an alternative to dairy in the American and Australian market is a good example of this.

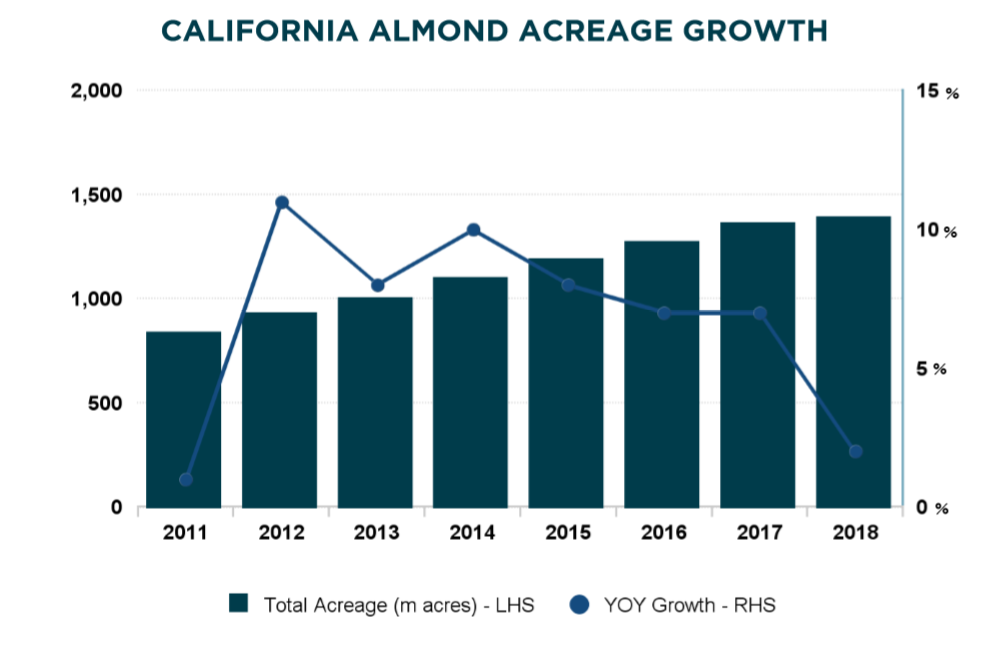

Compounding this dynamic is our view that the long-term global supply of almonds will be constrained by water availability in California.

California produces approximately 80% of the world’s almonds and the supply out of this region is the primary supply-side driver of global almond prices. Water access in California is undergoing a significant structural change due to the introduction of regulation and constraints on groundwater use.

Groundwater usage in California has historically been unregulated with landowners having the right to build a well and extract groundwater on their property. In 2014, the Sustainable Groundwater Management Act was passed, which provides a framework for long-term sustainable groundwater use.

Under the act, regions of California that are classified as critical overdraft zones need to have plans implemented by January 2020 that outline pathways to eliminate groundwater over-drafting. This means these regions cannot pump more water out of the underground aquifers than is being replenished each year.

While the direct impacts on almond growers remains unclear until these plans are released publicly in 2020, our research suggests it is very likely to reduce the overall amount of water available for crop irrigation and creates an uncertain outlook for total almond acreage and supply.

In this environment and given almond trees are a 35-year investment, we believe the growth in almond plantations will slow, and thus over the medium term, supply growth out of California will not match the ongoing growth in demand.

Supporting this thesis is the data from the California Almond Acreage Report, which shows that in 2018 total growth in Californian almond acreage fell to its lowest level in seven years.

Source: California Department of Food and Agriculture.

SHV exports most of its almonds and therefore the price it realises for the sale of its crop is highly leveraged to global almond prices. We believe the combination of a favourable outlook for global almond pricing due to the demand/supply dynamics and growth in production will underpin ongoing earnings growth over the medium to long term.

Despite the recent share price appreciation, we continue to believe SHV reflects good value and is an attractive mid-cap opportunity. Based on consensus forecasts for FY19, SHV is trading on a 16x P/E multiple and has a strong balance sheet.

A mid-cap stock, Select Harvest (ASX: SHV) represented 2.3% of the PIC portfolio as at 31 May 2019.