Investors in equity LICs who stayed the course over 2020 have generally done well while those who added to their holdings as discounts expanded sharply have done considerably better. Far from being yesterday’s news, LICs have shown they can be good contributors to a robust investment portfolio over the long term.

It’s hard to know where to invest in 2021 but listed investment companies (LICs) could be an option for clients targeting income streams. The LIC sector has recovered in line with the broader Australian equity market and, while unfashionable in some quarters, could be suitable for investors looking for returns beyond term deposits.

Listed investment entities, like our Perpetual Equity Investment Company Limited (PIC), raise capital from thousands of investors at a single point in time, unlike ETFs and unlisted managed funds which raise capital continuously from one investor at a time. Because of this fixed capital, LICs are one of the few entities that do not need to satisfy redemptions during times of uncertainty. Rather, they can be a buyer of assets as investing opportunities present themselves at good value.

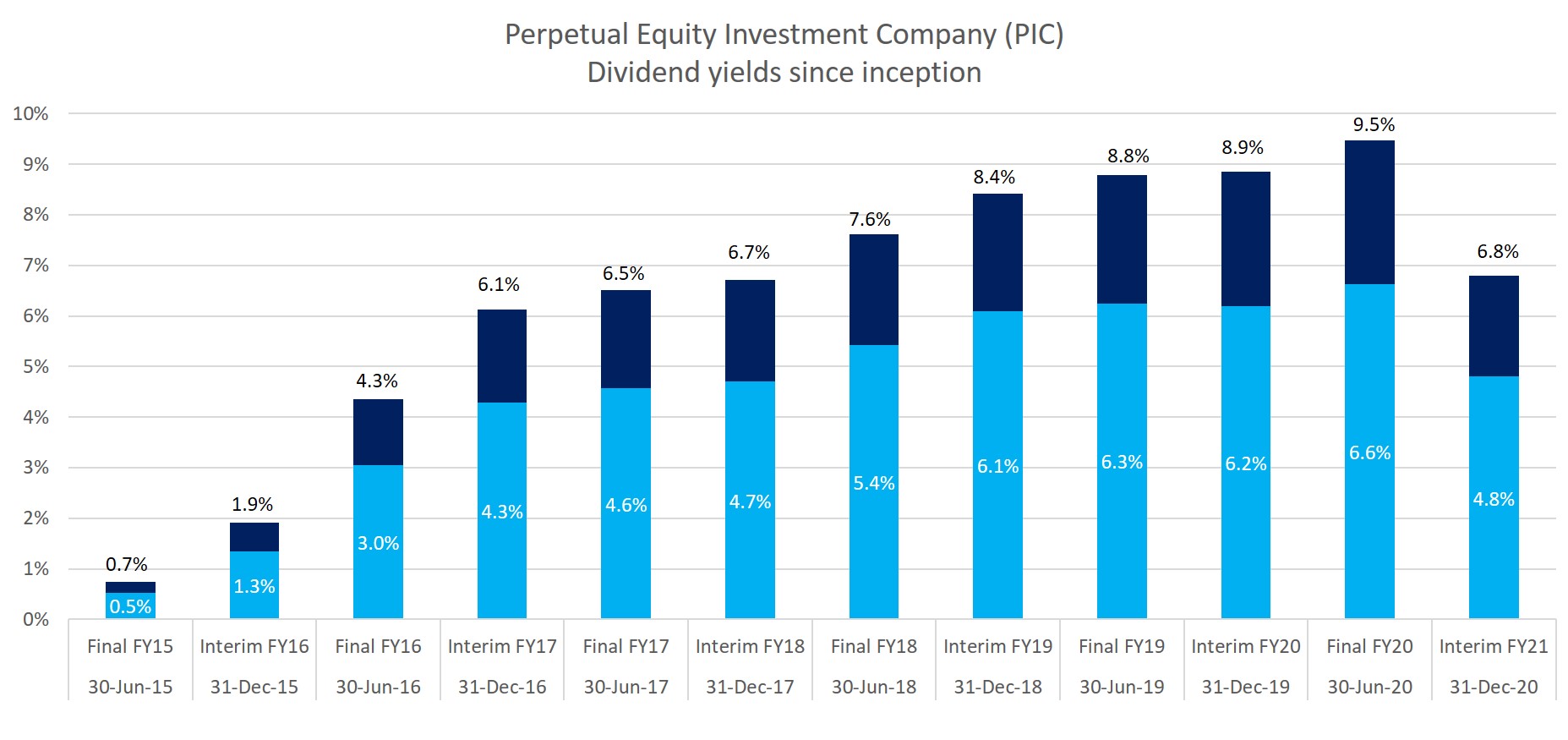

PIC has delivered a strong, consistent dividend yield since inception (see chart). As at 31 December 2020, PIC had an annual dividend yield of 4.8% and grossed up annual dividend yield of 6.8%1. In an environment where dividend income has become uncertain for many Australian listed companies, our active management style means we are not solely reliant on dividends received from underlying companies to generate franking credits in the portfolio. Rather, PIC portfolio manager, Vince Pezzullo and the team identify numerous opportunities throughout the year to also generate franking credits through realised gains in the trading portfolio.

Source: Perpetual Investment Management Limited; as at 31 December 2020.

Each dividend yield is calculated based on the total dividends of the past 12 months and the closing share price of the respective period. Grossed up yield takes into account franking credits at a tax rate of 30% except for the FY18 final dividend and FY19 interim dividend which were fully franked at a tax rate of 27.5%.

Source: Perpetual Investment Management Limited; as at 31 December 2020.

Each dividend yield is calculated based on the total dividends of the past 12 months and the closing share price of the respective period. Grossed up yield takes into account franking credits at a tax rate of 30% except for the FY18 final dividend and FY19 interim dividend which were fully franked at a tax rate of 27.5%.

The fact that a LIC can retain earnings even if the dividends paid by the companies that the LICs invests in disappoint is good news for investors seeking stable income. It also means that an attractive and consistent dividend yield is one of this financial product’s biggest selling points with investors.

According to Angus Gluskie, Chair of the Listed Investment Company and Trust Association (LICAT), closed-end funds provided unique advantages to investors, the broader economy and the financial markets system.

“The efficiency and stability of their closed-end structure coupled with the corporate governance disciplines of ASX listing have proven to be far more durable than many other investment structures.”

Further, according to Bell Potter2, the market capitalisation of ASX Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) grew 12.9% to $49.2bn in the December 2020 quarter.

The PIC portfolio performed well over December with top contributors to absolute performance being Flutter Entertainment Plc, HT&E Limited and Iluka Resources Limited. As a result, the portfolio generated a return of 2.1%, which compares to 1.3% for the S&P/ASX 300 Accumulation Index (benchmark). In the 12 months to 31 December 2020, the PIC portfolio returned 16.1%, outperforming the benchmark by 14.4%.

Our view is that the rotation to recovery and pro cyclical value stocks remains firmly on track for later this year as countries move towards society-wide COVID-19 vaccination and economic re-opening in the second half of the year. As a result, PIC has pre-emptively bulked up on stocks that it believes will benefit from any reflation coming out of this rotation, including Bluescope Steel Limited and Oil Search Limited. During December, we also added to our position in Flutter Entertainment and took profit in Aristocrat Leisure Limited by reducing position.

1. Yield is calculated based on the total grossed up dividends of 8.0 cents per share (taking franking credits into account), and the closing share price of $1.17 as at 31 December 2020.

2. Source: Bell Potter Quarterly LIC Report – December 2020.

This information has been prepared by Perpetual Investment Management Limited (PIML) ABN 18 000 866 535, AFSL 234426. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. To view the Perpetual Group's Financial Services Guide, please click here. The information is believed to be accurate at the time of complication and is provided in good faith. This document may contain information contributed by third parties. PIML and PSL do not warrant the accuracy or completeness of any information contributed by a third party. Any views expressed in this document are opinions of the author at the time and do not constitute a recommendation to act. This information, including any assumptions and conclusions is not intended to be a comprehensive statement of relevant practise or law that is often complex and can change. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital.