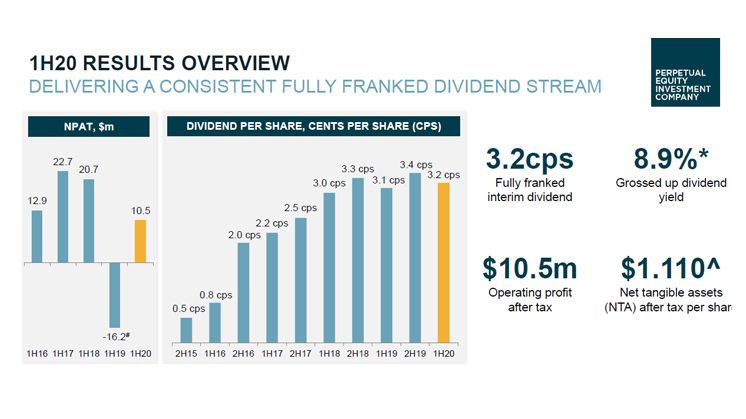

1H20 Summary:

- Operating profit after tax of $10.5 million

- A fully franked interim dividend of 3.2 cents per share

- Annual dividend yield of 6.2% and a grossed up dividend yield of 8.9%11

- Investment portfolio performance for the six months to 31 December 2019 was 3.6%2, outperforming the benchmark by 0.3%

- Net Tangible Asset after tax3 per share of $1.110 as at 31 December 2019

The Perpetual Equity Investment Company Limited (ASX:PIC; the Company) has announced a solid result for the six months to 31 December 2019, with operating profit before tax of $13.3 million and an operating profit after tax of $10.5 million. This represents a strong turnaround compared to the first half of financial year 2019 (1H19) which was impacted by unrealised losses attributed to market weakness.

The PIC Board has also declared a fully franked interim dividend of 3.2 cents per share. This equates to an annual dividend yield of 6.2% and a grossed up dividend yield of 8.9%1.

Chairman Nancy Fox said, “In December we marked a milestone with the five-year anniversary of PIC’s listing on the ASX. The Board is pleased the prudent management of the Company over that time has enabled fully franked dividends to be paid to shareholders each year, with a solid annual dividend yield now at 6.2%. We recognise the importance of this income to our shareholders and are focused on providing dividends that are sustainable over the long-term.”

The interim dividend will be paid on 24 April 2020. The dividend reinvestment plan (DRP) is available to shareholders for the interim dividend and will operate without a discount. The last election date for the DRP is 3 April 2020.

PIC performance and market conditions

The PIC portfolio delivered a return of 3.6%2 for the six months to 31 December 2019, outperforming the benchmark by 0.3%. As at 31 December 2019, the portfolio held 67.6% in Australian listed securities, 23.4% in global listed securities and 9.0% in cash.

PIC Portfolio Manager Vince Pezzullo said, “During the first half of the year, we increased the portfolio exposure to global listed securities from 5.6% in July to 23.4% in December 2019. We saw good value overseas, and our active management style enables us to take advantage of those opportunities. The ability to allocate up to 25% of the portfolio in global securities is particularly helpful when we see equivalent stocks in overseas markets representing much better value than their Australian counterparts. Importantly, in increasing this allocation, we have stayed true to Perpetual’s value investment style which is underpinned by a disciplined and bottom-up approach, focused on finding quality companies trading at attractive valuations.”

Half Year Results Teleconference

The Board would like to extend an invitation to all shareholders and interested parties to register for our Half Year Results teleconference on Monday 9 March 2020 at 12.00pm (noon) AEDT. To register for the event please click here or visit perpetualequity.com.au.

1. Yield is calculated based on the total grossed up dividends of 9.4 cents per share (taking franking credits into account), and the closing share price of $1.065 as at 31 December 2019.

2. Returns have been calculated on the growth of Net Tangible Assets (NTA) after taking into account all operating expenses (including management fees) and assuming reinvestment of dividends and excluding tax paid. Any provisions for deferred tax on unrealised gains and losses are excluded. The benchmark is the S&P/ASX 300 Accumulation Index. Past performance is not indicative of future performance.

3. ‘After tax’ refers to after tax paid and provisions for deferred tax on unrealised gains and losses of the Company’s investment portfolio.