Highlights:

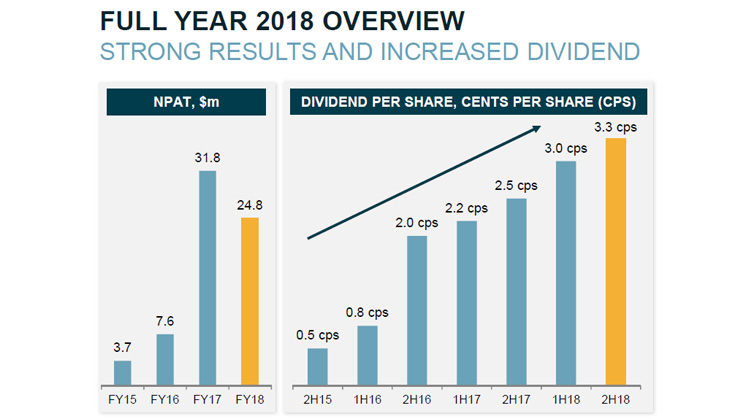

- Strong FY18 operating profit after tax of $24.8 million

- A fully franked final dividend of 3.3 cents per share

- Total shareholder return (dividends and share price appreciation) was 18.8%1

- Capital raising including a 1-for-4 Entitlement Offer for Eligible Shareholders plus a General Offer.

The Perpetual Equity Investment Company Limited (the Company) has announced its 2018 Financial Year result, posting an operating profit after tax of $24.8 million.

The Company has also today announced a capital raising under a Prospectus including an Entitlement Offer for existing Eligible Shareholders of 1 New Share for every 4 Existing Shares owned raising up to approximately $71.24 million at an issue price of $1.12, plus a $30 million General Offer. Shares not taken up under the Entitlement Offer will be offered under a Shortfall Offer. All New Shares issued under the Entitlement Offer, Shortfall Offer and General Offer will be eligible to receive the 2018 final dividend.

FY18 Results

The Company has posted an operating profit before tax of $32.3 million for the 12 months to 30 June 2018, with operating profit after tax of $24.8 million.

The Board has declared a fully franked final dividend of 3.3 cents per share - a 10% increase on the interim dividend announced in February 2018. This brings the total dividends declared for FY18 to 6.3 cents per share fully franked.

Company Chairman, Nancy Fox, said “The Board is pleased to deliver an increased dividend once again to our investors. The increase highlights the Board’s confidence in the Company’s performance coupled with the healthy franking account we have prudently built. We remain committed to delivering sustainable dividends for our shareholders in future years.”

Vince Pezzullo, the Company’s Portfolio Manager, said “FY18 has presented challenging conditions for a value oriented investment manager, however we have remained true to our quality and value style.

“We saw the trend of investors pursuing yield begin to underperform during the year, however growth (or quality at any price) continued to rerate throughout FY18 resulting in the outperformance of growth stocks versus value stocks, with price momentum now close to the highest levels of the past 20 years.

“Ultimately through the long term, fundamentals will determine share prices. The discipline of investing in quality businesses at reasonable prices and avoiding the irrational exuberance seen in some pockets of the market will serve investors well. We recognise the importance of valuation in determining future returns and understand that it is fundamentals, not headlines, which drive share prices in the long term. Importantly, at elevated prices it doesn’t take much to go wrong for investors to be caught out. We continue to maintain our investment process, philosophy and discipline to identify investment opportunities in high quality companies that are out of favour or mispriced.”

As at 30 June 2018, the Company’s Portfolio held 67% in Australian securities, 9% in global securities and 24% in cash.

The Company’s shares will trade ex-dividend on 18 October 2018, and the final dividend will be paid on 2 November 2018. The dividend reinvestment plan will be temporarily suspended due to the capital raising.

Capital raising

In a move to address expected investor demand, the Company has announced a capital raising for existing and prospective shareholders via the Entitlement Offer, Shortfall Offer and General Offer (collectively the Offer). Perpetual Investment Management Limited (the Manager) is paying the costs of the Offer. The Company will not accept oversubscriptions.

Ms Fox said, “This capital raising is the logical next step for our shareholders and the Company.

“We have seen continued appetite among investors for a diversified portfolio of high quality Australian and global listed securities via the ASX and managed by Perpetual Investment Management Limited. Many shareholders also continue to seek tax effective income and the Company remains committed to delivering a regular fully franked dividend stream,” Ms Fox said.

The Company first listed on the ASX in December 2014, raising more than $250 million from investors. At the time, it was the largest raising for a listed investment company following the global financial crisis.

Ms Fox added, “We received tremendous support from investors when the Company listed. The Company has been managed prudently and responsibly since then, and the Board believes the next phase of growth is to raise additional capital.”

Mr Pezzullo said “We will allocate the additional capital into the portfolio. Additionally, we will continue to find opportunities in the market and it’s important to be positioned and have capital ready to deploy to take advantage of attractive investment opportunities as they arise.”

Capital will be raised through a combination of:

- Entitlement Offer - An offer to Eligible Shareholders to participate in a non-renounceable pro rata Entitlement Offer of 1 New Share for every 4 Existing Shares held at an issue price of $1.12 per New Share to raise up to approximately $71.24 million;

- Shortfall Offer – If the Entitlement Offer is not fully taken up by Eligible Shareholders, an offer of the shortfall to Eligible Shareholders who wish to apply for additional New Shares and the general public at an issue price of $1.12 per share; and

- General Offer – an offer to the general public to purchase New Shares at an issue price of $1.12 to raise up to $30 million.

The Entitlement Offer closes at 5.00pm (AEST) on Wednesday, 26 September 2018.

The General Offer and Shortfall Offer closes at 5.00pm (AEST) on Friday 28 September 2018.

All New Shares issued under the Entitlement Offer, Shortfall Offer and General Offer will be eligible to receive the 2018 final dividend. All directors of the Company intend to take up their entitlement under the Entitlement Offer.

The Joint Lead Managers for the offer are Commonwealth Securities Limited, Morgans Financial Limited and Taylor Collison Limited.

The Entitlement Offer and General Offer will be made in a Prospectus issued by the Company and you should obtain and read a copy of the Prospectus in its entirety before considering whether to apply for shares in the Company. The Prospectus contains further details about the capital raising, including eligibility and key dates. You will also need to complete the application form contained in, or accompanying, the Prospectus. You can download an electronic copy of the Prospectus here. You can also request a paper copy of the Prospectus and the application form by calling the Offer Information Line on (+61) 1800 421 712 between 8.30am and 5.30pm (AEST), Monday to Friday.

2018 Investor Roadshow

The Board would like to extend an invitation to all shareholders and interested parties to attend our 2018 annual investor roadshow being held in capital cities throughout September 2018. Please register here. We look forward to seeing you.

View the Annual Report to 30 June 2018

The issuer of the securities referred to in this publication is Perpetual Equity Investment Company Limited ACN 601 406 419. Further information on the Company is available is on this website.

The Company’s investment portfolio is managed by Perpetual Investment Management Limited (ACN 000 866 535 AFSL 234426), part of the Perpetual Group. Any general advice in this publication is issued by Perpetual Trustee Company Limited (ACN 000 001 007 AFSL236643). The information contained in this publication should be used as general information only. It does not take into account the particular objectives, financial situations or needs for investment of any investor, or purports to be comprehensive or constitutive investment advice and should not be relied upon as such. Before acting on the information in this publication, you should consider, with your financial adviser, whether the information is appropriate having regard to your individual objectives, financial situation and needs.

[1] Total shareholder return (1 year to 30 June 2018) assumes reinvestment of dividends.