FY21 Summary:

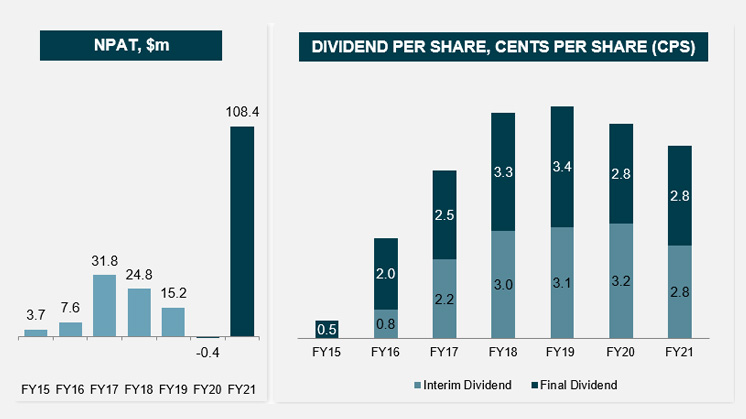

- Net operating profit after tax of $108.4 million

- A fully franked final dividend of 2.8 cents per share, with a total dividend for FY21 of 5.6 cents per share fully franked

- Annual dividend yield of 4.3% and a grossed up dividend yield of 6.2% 1

- Investment portfolio performance of 42.4%, outperforming the benchmark by 13.9% for the 12 months to 30 June 2021 2

- Successful capital raising in excess of $30 million

- Net Tangible Assets (NTA) after tax per share of $1.299 as of 30 June 2021 3

- Total shareholder return was 51.2% , outperforming the benchmark by 22.7%4

The Perpetual Equity Investment Company Limited (ASX:PIC; the Company) has announced its annual results for financial year 2021 (FY21), posting a net operating profit after tax (NPAT) of $108.4 million, and an operating profit before tax of $152.9 million. This represents a record financial year profit for the Company since listing on the ASX in 2014.

The Board has declared a fully franked final dividend of 2.8 cents per share, bringing the total dividend for FY21 to 5.6 cents per share fully franked. This is reflective of the Company’s commitment to deliver income to shareholders and equates to an annual dividend yield of 4.3% and a grossed up dividend yield of 6.2%1.

Chairman Nancy Fox said, “The Board is delighted with the strong results the Company has delivered in FY21, including a record profit, solid portfolio outperformance2 and total shareholder return above the benchmark4. Despite the current environment remaining uncertain due to the impacts of COVID-19, we have continued to provide a reliable income stream to our shareholders. This is attributable to the prudent management of the Company which has enabled the Board to deliver a fully franked total dividend of 5.6 cents per share this year.”

The final dividend will be paid on 20 October 2021. The dividend reinvestment plan (DRP) is available to shareholders for the final dividend. The last election date for the DRP is 30 September 2021 and the record date for the dividend is 29 September 2021.

“The Board also remains very encouraged by the strong support received from our eligible shareholders who participated in the Company’s Share Purchase Plan (SPP) in June, which raised over $30 million. The proceeds have enabled the Manager to actively pursue additional investments in line with the Company’s investment strategy. We believe the SPP and bonus issue of Options have provided all eligible PIC shareholders with the opportunity to participate in the potential growth of the Company, which we believe will benefit all shareholders,” Ms Fox commented.

PIC performance and market conditions

The PIC portfolio delivered a return of 42.4% for the 12 months to 30 June 2021, outperforming its benchmark by 13.9%5. As at 30 June 2021, the portfolio held 72.5% in Australian listed securities, 20.5% in global listed securities and 7.0% in cash. The higher cash allocation compared to the preceding months leading up to 30 June was partly a result of receiving proceeds from the Company’s SPP of around $30 million on 23 June 2021.6

PIC Portfolio Manager Vince Pezzullo said, “We were pleased to outperform the benchmark by almost 14%5 over FY21. This is reflective of our active investment approach and intensive company research which enables us to adapt to changing market conditions and adjust the portfolio quickly. The market volatility led by COVID-19 provided opportunities to invest in companies with strong balance sheets which we believed were undervalued and would benefit as economies reopened. As global markets moved through the recovery cycle and economies began to reopen, we saw the benefits of our continued focus on quality and value realised. In addition, our flexible investment strategy including the ability to invest up to 35% in global listed securities also contributed to outperformance over the period.”

Nancy Fox said, “The Board is committed to delivering on the Company’s investment objective of providing income and long-term capital growth to shareholders. The market volatility over the last 18 months in particular has demonstrated the importance of prudent capital management and active investment management. At this time, we believe consolidating on the Company’s strong FY21 result by retaining more capital for investment and continuing to build a healthy franking account balance, positions the Company well to continue to provide returns to shareholders over the long-term.”

2021 Annual Shareholder Presentation

The Board extends an invitation to all shareholders and interested parties to attend the 2021 Annual Shareholder Presentation on 21 October 2021. Please visit https://www.perpetualequity.com.au for more information.

1. Yield is calculated based on the total grossed up dividends of 8.0 cents per share (taking franking credits into account) and the closing share price of $1.30 as at 30 June 2021.

2. The benchmark is the S&P/ASX 300 Accumulation Index. Returns have been calculated on the growth of NTA after taking into account all operating expenses (including management fees) and assuming reinvestment of dividends and excluding tax paid. Any provisions for deferred tax on unrealised gains and losses are excluded. Past performance is not indicative of future performance.

3. ‘After tax’ refers to tax paid and provisions for deferred tax on unrealised gains and losses in the Company’s investment portfolio.

4. Total shareholder return for the 12 months to 30 June 2021. Source: FactSet; Performance presented in AUD, based on the ASX share price assuming reinvestment of dividends on the ex-date.

5. The benchmark is the S&P/ASX 300 Accumulation Index. Returns have been calculated on the growth of NTA after taking into account all operating expenses (including management fees) and assuming reinvestment of dividends and excluding tax paid. Any provisions for deferred tax on unrealised gains and losses are excluded. Past performance is not indicative of future performance.

6. Full details of the outcome of the SPP were announced to the ASX on 21 June 2021.