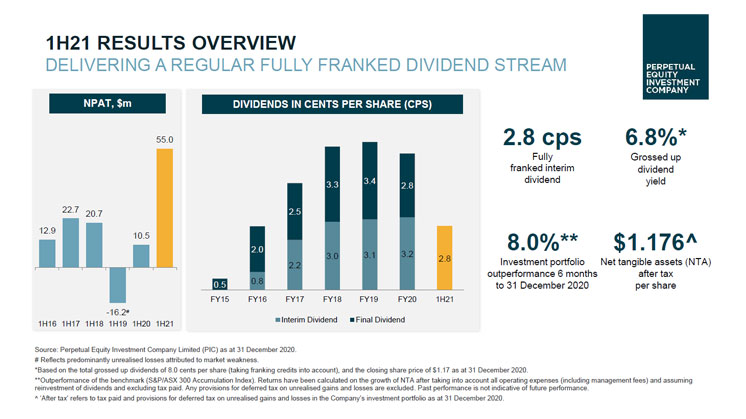

1H21 Summary:

- Net operating profit after tax of $55.0 million

- A fully franked interim dividend of 2.8 cents per share

- Annual dividend yield of 4.8% and a grossed up dividend yield of 6.8%1

- Investment portfolio performance for the six months to 31 December 2020 was 21.7%2, outperforming its benchmark by 8.0%

- Net Tangible Asset after tax3 per share of $1.176 as at 31 December 2020

The Perpetual Equity Investment Company Limited (ASX:PIC; the Company) has announced a strong result for the six months to 31 December 2020, with operating profit before tax of $77.6 million and an operating profit after tax of $55.0 million. This represents a record profit since the Company listed on the ASX in 2014.

The Board has declared a fully franked interim dividend of 2.8 cents per share which is consistent with the FY20 final dividend. The Board believes this translates to an attractive annual dividend yield of 4.8% and a grossed up dividend yield of 6.8%1.

Chairman Nancy Fox said, “The Board is encouraged by the record profit and strong portfolio performance over the first half of financial year 2021 and is pleased to deliver a fully franked dividend. We understand the value our investors place on income, especially in this current period, and we are proud of our established track record of paying fully franked dividends twice a year to shareholders.

“At this time, we believe consolidating the Company’s strong half year result by retaining more capital for investment and building a healthy franking account balance, positions the Company well to provide returns to shareholders over the long-term.

“Our approach to capital management seeks to strike an appropriate balance of providing income to shareholders while maintaining profit reserves and franking credits for the payment of future dividends. In doing so, we believe this will continue to grow the capital base of the Company and allow it to pass on the accumulated benefits over time via regular or special dividends.”

To reflect this prudent approach and the maturity of the Company, the Board also considers it appropriate to make a small change to the investment objective4 at this time. Effective today, the investment objective is to provide investors with an income stream and long-term capital growth in excess of its benchmark (the S&P/ASX 300 Accumulation Index) over minimum 5 year investment periods. Importantly, while the investment objective shifts, the Board remains committed to paying a dividend to shareholders twice a year, fully franked or to the maximum extent possible.

PIC performance and market conditions

The PIC portfolio delivered a return of 21.7%2 for the six months to 31 December 2020, outperforming the benchmark by 8.0%. As at 31 December 2020, the portfolio held 68.4% in Australian listed securities, 26.7% in global listed securities and 4.9% in cash.

PIC Portfolio Manager Vince Pezzullo said, “We are pleased to have been able to outperform the benchmark by 8.0% during the first half of the financial year. The Company’s flexible investment strategy combined with our in-depth research and extensive investment team has enabled us to identify numerous attractive investment opportunities and adapt swiftly to changing market conditions.”

“While we expect volatility to continue, we are of the view that the rotation to recovery and pro- cyclical value stocks is on track for later this year. As a result, we continue to position the portfolio with quality stocks we believe are well placed to benefit from this rotation. Our active approach and ability to invest domestically and globally allows us to take advantage of a range of opportunities across all market cycles.”

1. Yield is calculated based on the total grossed up dividends of 8.0 cents per share (taking franking credits into account), and the closing share price of $1.17 as at 31 December 2020.

2. Returns have been calculated on the growth of Net Tangible Assets (NTA) after taking into account all operating expenses (including management fees) and assuming reinvestment of dividends and excluding tax paid. Any provisions for deferred tax on unrealised gains and losses are excluded. The benchmark is the S&P/ASX 300 Accumulation Index. Past performance is not indicative of future performance.

3. After tax’ refers to after tax paid and provisions for deferred tax on unrealised gains and losses of the Company’s investment portfolio.

4. The previous investment objective of the Company was to provide investors with a growing income stream and long-term capital growth in excess of its benchmark (the S&P/ASX 300 Accumulation Index) over minimum 5 year investment periods.