1H19 Summary

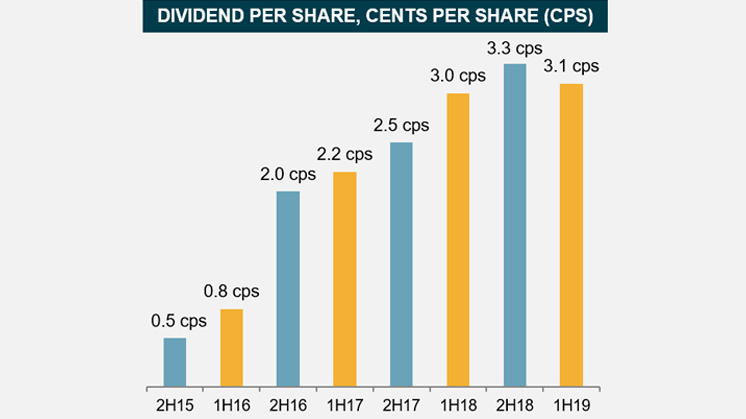

- A fully franked interim dividend of 3.1 cents per share, a 3% increase on 1H18

- Annual dividend yield of 6.1% and a gross dividend yield of 8.45% 1

- Operating loss after tax of $16.2 million

- Investment portfolio performance for the six months to 31 December 2018 was -6.5%, outperforming the benchmark by 0.5%2

- Net Tangible Asset backing per share of $1.055 after tax3 as at 31 December 2018

- Successful capital raising of $101 million

The Perpetual Equity Investment Company Limited (ASX:PIC; “the Company”) has declared a fully-franked interim dividend of 3.1 cents per share, a 3% increase on 1H18, reflecting the Company’s commitment to paying a regular dividend to shareholders. The dividend will be paid on 26 April 2019.

The fully franked interim dividend will provide shareholders with an annual dividend yield of 6.1% and a gross dividend yield (taking franking credits into account) of 8.45%1. The Company remains focused on paying dividends to provide a yield which compares favourably to the Australian market dividend yield.

Chairman Nancy Fox said, “The Board recognises our shareholders value a sustainable dividend stream and is pleased to announce an increased interim dividend for the first half of the year. During a time of market volatility and overall market weakness, we have achieved this for our investors through prudent management of the Company.

“We continue to monitor the Company’s franking balance, particularly in light of Labor’s franking credit proposal. The Manager has been strategically managing the portfolio to protect franking credits for investors. In anticipation of potential legislative change, the Board is also actively considering its response to facilitate investors receiving the benefits of accumulated franking credits. This is consistent with our prudent management approach.”

The dividend reinvestment plan (DRP) is available to shareholders for the interim dividend. The plan will operate at a 2.5% discount. The last election date for the DRP will be 5 April 2019.

The Company has also announced an operating loss before tax of $24.8 million and an operating loss after tax of $16.2 million, for the six months ended 31 December 2018.

PIC Chairman Nancy Fox said, “The operating loss is largely a result of unrealised losses attributed to market weakness during the first half of 2019, however the subsequent improvement in market conditions has seen an upturn in this position.”

Capital raising

During the first half of FY19, PIC received a strong response from investors for the capital raising, fulfilling the full offer amount of $101.24 million at the end of September 2018.

Commenting on the capital raise, Ms Fox said, “The Board was pleased with the level of investor support for the capital raising both from existing and new shareholders. The strong commitment we received demonstrated ongoing investor demand for quality investment expertise. The proceeds have allowed the Company to take advantage of market opportunities as they arise and provide investors continued access to sustainable income.”

PIC Portfolio Manager Vince Pezzullo commented, “The Australian equity market fell by 8.4% during the December quarter which provided us with an excellent opportunity to deploy the proceeds of the recent capital raising into quality companies trading at attractive prices. The funds have been fully invested.”

PIC performance and market conditions

The PIC portfolio delivered a return of -6.5% for the six months to 31 December 2018, outperforming the benchmark by 0.5%1. As at 31 December 2018, the portfolio held 79% in Australian listed securities and 21% in cash.

PIC Portfolio Manager Vince Pezzullo said, “The ongoing market volatility has been challenging for the industry and created some uncertainty. We believe value investing will return to favour as market conditions continue to change. We continue to focus on strategically managing the portfolio and our disciplined investment approach to deliver sustainable income for our investors over the long run.”

Half Year Results Teleconference

The Board would like to extend an invitation to all shareholders and interested parties to register for our Half Year Results teleconference on Wednesday 13th March 2019 at 12.00pm (noon) AEDT.

The issuer of the securities referred to in this publication is Perpetual Equity Investment Company Limited ACN 601 406 419. Further information on PIC is available at www.perpetualequity.com.au.

PIC’s investment portfolio is managed by Perpetual Investment Management Limited (ACN 000 866 535 AFSL 234426) (PIML), part of the Perpetual Group (Perpetual Limited ABN 86 000 431 827and its subsidiaries). This information has been prepared by PIML. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. This information does not constitute an offer, invitation, solicitation or recommendation with respect to the purchase or sale of PIC’s securities. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

1. Yield is calculated based on a grossed up dividend of 8.8 cents per share, and the closing share price of $1.045 on 31 December 2018.

2. ‘After tax’ refers to after tax paid and provisions for deferred tax on set-up costs and on unrealised gains and losses in the company’s investment portfolio.

3. Yield is calculated using the 2H17 dividend, the 1H18 dividend and the 12 February 2018 share price of $1.09. Grossed up yield takes franking credits into account.