Rising volatility

Global financial markets have experienced a very strange start to the year. In January the US market recorded its best start to the year since 1987, but in the past two weeks rising bond yields have exposed fragilities in asset valuations and have sparked the largest decline in US shares since August 2011, wiping out all of the January rise in the process and entering bear market territory.

The problem - global growth is rising strongly

The selling pressure this week has been more intense than during the Greek debt crisis of 2015 and the Brexit aftermath in 2016. Unlike the decline in 2015/16 when investors feared recession, the problem in 2018 is that the strength of the global economy, combined with (appropriate) central bank policy withdrawal, has driven bond yields higher and prompted investors to examine the price they are paying for risk assets, despite the improving growth picture.

Global economic growth in 2017 saw its largest rise (+0.6% to +3.1% y/y) for seven years and it will lift again this year. With the end of advanced economy de-leveraging in 2016 and a recovery in global business investment in 2017, emergency central bank policy settings are simply no longer appropriate and need to be withdrawn before they culminate in major economic dislocation.

So the risk is the price, not the earnings

The strength of the regional economic rebound over the past 18 months has seen large upgrades to earnings expectations in both the US and Emerging Markets (EM) and this indicates that the risk for sharemarkets this year is not earnings growth, it’s the price that investors are willing to pay for those earnings. Indeed the MSCI World Sharemarket Index is now trading at a P/E ratio of 18x forward earnings which is the highest level since March 2004.

Rising bond yields and sharemarket valuations simply won’t last

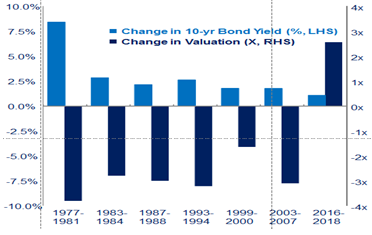

History shows that elevated sharemarket valuations do not by themselves cause sharemarket declines, but 93% of market corrections are prompted by either economic recession or higher interest rates. In the past six bond bear markets dating back to 1977, higher yields have been associated with lower sharemarket PE ratios. Since 1980, in bond bear markets yields have risen an average +220 basis points from trough to peak, and P/Es have on averaged declined by -2.75x in response (see Chart 1).

Chart 1: Higher bond yields always mean lower valuations since 1977

Chart 1 shows us what happened from the end of the cycle relative to the beginning, but it tells us nothing of the journey in the middle. Interestingly, four of the previous periods of rising yields saw temporary rises in valuations before it reversed. On average, it took +1.5% of bond yield increase to have valuations peak and then head lower. US Treasuries have risen +1.4% since their 2016 trough, which suggests that we could be very close to a structural change this cycle.

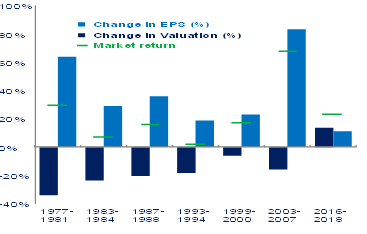

Falling valuations don’t lead to overall investment losses

History tells us that rising yields by themselves are nothing to fear. The key question is whether there is enough EPS growth so late in the cycle. In the US, wages growth is picking up which will compress margins, and while tax cuts provide temporary relief, this may be camouflaging US EPS challenges ahead. Other markets such as EM are earlier in their cycle and have growth momentum and operational leverage still to kick in.

Chart 2: US EPS growth is normally enough to offset PE contraction

Investment implication

With the US market down -10.1% in a matter of days, investors may be thinking: where to from here? In the end, extremely low interest rates have underpinned a build-up of some very exotic positions in markets over recent years, and these are in the process of unwinding. Despite recent volatility, 2018 returns will be determined by the fundamentals and how much the strong global economy pushes earnings growth and interest rates higher. The key for investors is finding alternative sources of diversification as bonds have been the source of risk recently, rather than a diversifier of it.

Regards,

|

Matt Sherwood Head of Investment Strategy, Multi Assets. |

This commentary has been prepared by Perpetual Investment Management Limited ABN 18 000 866 535 AFSL 234426. The views expressed in the article are the opinions of the author at the time of writing and do not constitute a recommendation to act. Any information referenced in the article is believed to be accurate at the time of compilation and is provided by the author in good faith. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.